April 25, 2023

Why Stay The Course?

Portfolio Manager Keith Leslie on the temptations and pitfalls of trying to time the market, and why it’s best to stay the course.

One of the most basic investment principles can be surprisingly difficult to grasp. Intuitively, you might think that if you lose 10% one year and make 10% the next year, you will break even. But that is not true, and it becomes even less true as losses become larger.

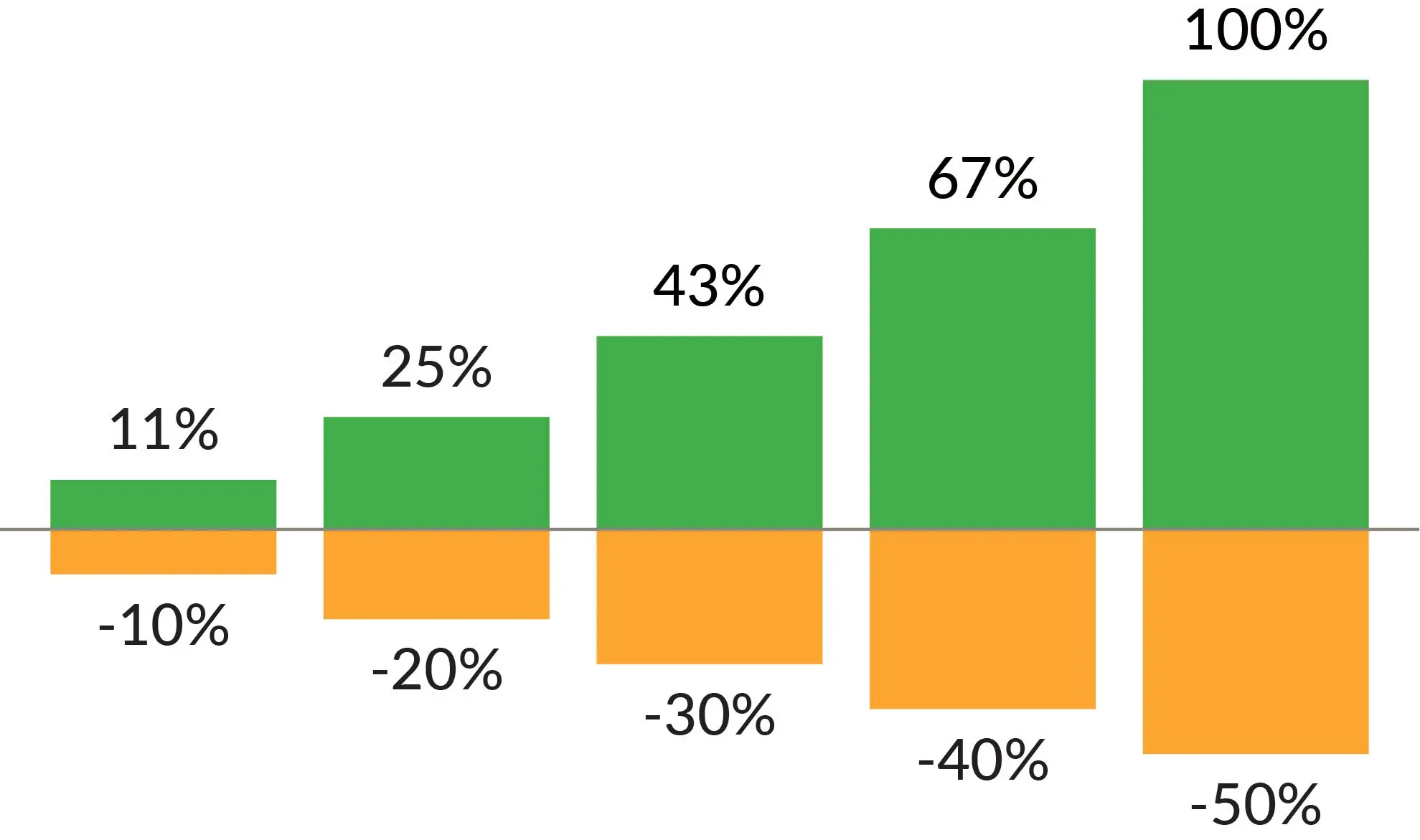

As the following chart shows, you need an 11% return to recover from a 10% loss. And the larger the loss, the harder it is to catch up. In the extreme, if your portfolio goes down 50%, you need to make 100% just to get back to even.

This is why, in our opinion, protecting on the downside is more important than trying to “shoot the lights out,” or even to always keep pace on the upside.

One of the best ways to protect your portfolio is through diversification. Diversification can be by many factors, including asset class, country, investing style, market capitalization, and more. The trick is to know each holding’s “job” in the overall portfolio. Is the holding there for protection or growth? When adding a new position, does it help diversify the overall portfolio or is it similar to another holding?

It can be easy to forget about the jobs you intend your holdings to perform, then make emotional decisions that are counter to the portfolio’s long-term goals. For example, a holding that’s intended to protect in down markets will likely underperform in strong markets, and a position held for growth might hurt the portfolio when markets are weak. Forgetting about this or becoming impatient is one of the main reasons investors go off course and suffer negative consequences.

Markets vs. human nature

Markets have done well over time, but investors don’t always do as well. A perfect example comes from investment company Fidelity and its flagship Magellan Fund, which delivered a stellar 29% average annual return between 1977 and 1990. Despite this performance, the average investor actually lost money. (Source: Dash, J. (2021, June 2). Council post: How investors are costing themselves money. Forbes. Retrieved March 15, 2022.)

How is that possible? According to Fidelity, investors would run for the doors during periods of poor performance and come rushing in after periods of success.

It is human nature to chase performance and buy what did well last year, but that goes counter to the concept of intelligent investing. If your portfolio is set up so that everything does well in a given year, that means everything can also do poorly in a given year. Being a successful investor over the long-term involves diversifying your portfolio with investments designed for different market conditions.

What about the bears?

Bear markets are never easy, but the market has been incredibly resilient. For example, since the bottom of the Great Recession in March 2009, the S&P 500 has delivered a return of 727% including dividends through March 31, 2023.

Go back further and you will see that, in the 50-year period ending December of 2022, the S&P 500 returned more than 13,000%. It may help to keep this history in mind when you contemplate market volatility. If you had invested $10,000 in the S&P 500 at the start of 1973 and just left it there, it would be worth more than $1.3 million today. (Source: Bloomberg SPX Index Total Return CAD, March 31, 2023.)

When a bear market hits, it may take a while to recover. As we saw a moment ago, a 30% drop necessitates a 43% recovery. But look at how the power of compounding can help. If your $100 investment declines to $70 and you make 10% the next year, you’re back up to $77. The next 10% gets you to nearly $85. Two more years of 10% gains, and you have $102.50.

A roller coaster of emotion

The trick to effective diversification and compounding returns is to stay the course. Investing based on panic or gut feelings will almost always lead to underperformance. Most investors are incapable of ignoring these reactions, which is why they hire professional advisors or money managers to look after their portfolios.Investment professionals are trained to look at the long term and the big picture. Unfortunately, even this is not foolproof, because some investors will second guess their long-term plans based on short-term performance. Some will even abandon their advisors during market downturns, just to repeat the process again in the next downturn.

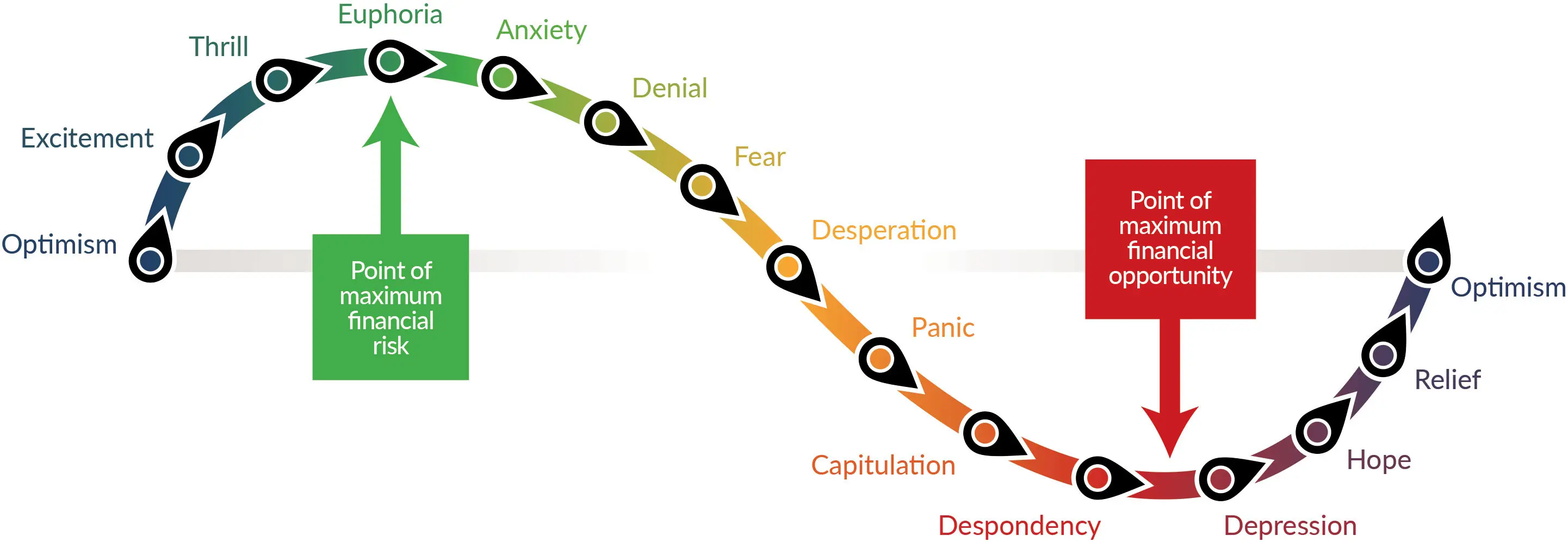

The following illustration highlights the emotional cycle of investing. Failing to control for these emotions leads to some of the most common investor errors, such as chasing returns, buying high/selling low, panic selling, making decisions based on individual holdings rather than an overall portfolio, lack of diversification, and purchasing narrowly-focused investments rather than broad asset classes.

Map out your course

Perhaps the best way to stay the course is to have it clearly mapped out. Spend time finding a professional advisor who you trust, then work with them to document your goals and set a long-term financial plan. After that, you can let them run your portfolio based on your strategy, without overreacting to short-term events.

Think of it as you do your winter coat. You do not get rid of it in the summer - you continue to hold onto it for when it is needed. As an investor, you should understand why you own the investments that you do and be reluctant to change them unless there is a different “job” that needs to be done in your portfolio. I would like to finish with one of my favourite quotes by the legendary investor, Benjamin Graham, which highlights the importance of having the right strategy and discipline to stay the course:

“The essence of portfolio management is the management of risks, not the management of returns.”

Author

Keith Leslie, CFA

Portfolio Manager of Canadian equities with over 24 years of investment management experience.